The Ultimate Guide to Making Use Of a Secured Credit Card Singapore for Better Financial Administration

The Ultimate Guide to Making Use Of a Secured Credit Card Singapore for Better Financial Administration

Blog Article

Charting the Path: Opportunities for Charge Card Access After Bankruptcy Discharge

Browsing the world of credit history card access post-bankruptcy discharge can be an overwhelming job for people looking to reconstruct their economic standing. From secured credit rating cards as a tipping stone to potential paths leading to unsafe credit scores possibilities, the trip in the direction of re-establishing creditworthiness requires mindful consideration and educated decision-making.

Recognizing Credit Rating Fundamentals

Understanding the basic principles of credit report is necessary for people looking for to browse the intricacies of monetary decision-making post-bankruptcy discharge. A credit rating is a numerical depiction of a person's creditworthiness, suggesting to lending institutions the degree of threat related to prolonging credit score. Numerous aspects contribute to the computation of a credit rating, consisting of payment history, amounts owed, length of credit report, new credit rating, and types of debt made use of. Repayment background holds considerable weight in identifying a credit history, as it shows an individual's ability to make timely settlements on arrearages. The quantity owed about readily available credit score, likewise recognized as credit score utilization, is one more crucial variable influencing credit history. Additionally, the length of credit report showcases an individual's experience handling credit report over time. Comprehending these crucial components of credit score scores equips individuals to make enlightened financial decisions, rebuild their credit rating post-bankruptcy, and job towards achieving a much healthier financial future.

Protected Credit Score Cards Explained

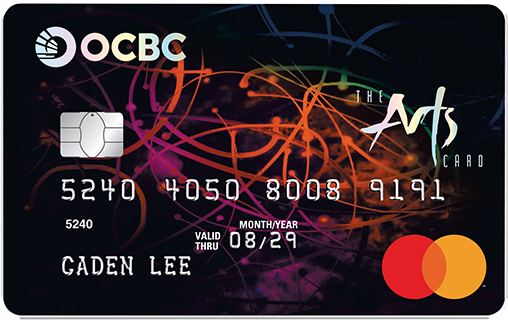

Safe charge card provide a valuable monetary tool for individuals aiming to reconstruct their credit history adhering to an insolvency discharge. These cards need a protection deposit, which typically figures out the credit scores limit. By making use of a secured charge card properly, cardholders can show their credit reliability to prospective lending institutions and gradually enhance their credit history.

One of the crucial benefits of safeguarded charge card is that they are much more easily accessible to people with a minimal credit rating or a damaged credit history - secured credit card singapore. Given that the credit line is safeguarded by a down payment, companies are extra happy to approve applicants who may not receive conventional unsecured wikipedia reference charge card

Credit Rating Card Options for Rebuilding

When seeking to restore credit after personal bankruptcy, discovering various credit history card choices customized to individuals in this economic circumstance can be helpful. Protected credit cards are a prominent choice for those looking to reconstruct their credit rating. One more alternative is coming to be an accredited customer on a person else's credit report card, permitting individuals to YOURURL.com piggyback off their credit scores background and possibly enhance their own rating.

How to Qualify for Unsecured Cards

Monitoring credit rating records consistently for any mistakes and disputing mistakes can even more improve credit ratings, making individuals much more appealing to debt card companies. Additionally, people can think about applying for a safeguarded credit scores card to rebuild credit rating. Secured credit score cards need a cash down payment as security, which reduces the danger for the provider and enables people to show liable credit scores card usage.

Tips for Accountable Bank Card Use

Building on the foundation of enhanced creditworthiness developed via responsible economic administration, individuals can boost their total monetary wellness by implementing essential suggestions for responsible credit scores card use. Furthermore, maintaining a low credit score application proportion, preferably listed below 30%, shows liable credit score use and can positively impact credit ratings. Avoiding from opening up multiple brand-new credit scores card accounts within a short period can stop potential credit report rating damage and too much debt build-up.

Final Thought

To conclude, individuals who have declared bankruptcy can still access bank card via numerous options such as safeguarded charge card and restoring debt (secured credit card singapore). By comprehending debt rating essentials, getting unsecured cards, and exercising accountable charge card usage, people can gradually rebuild their creditworthiness. It is crucial for individuals to carefully consider their economic circumstance and make notified decisions to boost their credit standing after insolvency discharge

A number of elements contribute to the estimation of a credit rating score, consisting of settlement background, amounts owed, size of credit rating background, new credit scores, and types of credit rating utilized. The quantity owed family member to readily available debt, also known as credit usage, is an additional vital variable influencing credit report ratings. Keeping track of debt reports frequently for any mistakes and contesting mistakes can even more enhance debt ratings, making individuals much more attractive to credit score card providers. Additionally, keeping a low credit utilization ratio, preferably below 30%, demonstrates responsible credit score usage and can positively affect credit report scores.In final thought, individuals who have filed for personal bankruptcy can still access debt cards via various alternatives such as protected credit report cards and restoring credit history.

Report this page